- Air freight news – Post date: December 15th, 2020

FLIGHTS iNCREASING, VACCINES COMING – AND DRONE DELIVERIES

Despite the rebound of the pandemic in Europe and the partial lockdown in some countries, some most airlines have increased their number of flights. According to Accenture, over the past 2 weeks 10,000 tonnes of air cargo capacity have been added globally; 11,000 tonnes correspond to increases in widebody belly and 7,000 to integrated capacity, offset by a 7,700 decrease in airline freighters.

Most airlines are focusing to prepare for vaccination transport requirements: extreme low controlled temperature (–70°C) and connections to distribute all over the world. The African continent is also preparing, with many airports setting up special facilities, including Ethiopian Airlines in Addis Ababa, and Kenya Airways and Astral in Nairobi. These operations may reduce the regular capacity of flights, causing a rise in costs.

In terms of delivery, Africa is leading the development of deliveries using drones. Wings for Aid is preparing an alternative that could deliver up to 160 kg, giving quick access and solutions for locations that are difficult to reach.

In other news, at least 1,500 passenger aircraft are planned to be modified into cargo planes to meet current demand for this type of aircraft.CARGO FLIGHTS – UPDATES

Download the Excel tool that contains information on most cargo flights available in one database. Please allow macros for the file to work properly.

Logistics country-by-country – UPDATES

The individual logistics situtation and operations for each country are listed in an Excel database. This country situation report is based on reports from the World Food Program, Bolloré Logistics and Logistics Cluster.

Senegal: Dakar international airport records 52% drop in air traffic

Dakar international airport saw its traffic fall by 52% from January to November 2020 due to Covid-19, which paralysed operations for 4 months. The Senegalese hub, which is completing its third year of service, handled nearly 2.5 million passengers in 2019. In 2020 the airport recorded only 48% of 2019 traffic (Africa Logistics Magazine, 12 December).

Regional overview: Middle East & Africa

In line with most other regions around the world, capacity in the Middle East and Africa is down by 53% in 2020. These regions have fared slightly better than Latin America, where capacity has reduced by 55% across the year. Capacity is currently forecast to rise by 43% next year, in line with the global position of a 42% upswing. This includes revisions made since the positive news on Covid-19 vaccines (Routes Online, 4 December).

UK, Kenya deal for tariff-free fresh produce trade

This is the sixth bilateral trade deal between the UK and Kenya, a trade deal already worth £1.4 billion a year. The UK is by far the largest foreign investor in Kenya. The value of British investment in Kenya was estimated at £2.7 billion in 2017, with over 220 UK firms setting up businesses in the country.

Perishable Movements Limited will continue to provide logistics support to Kenyan exporters and UK importers, and has recently expanded its operation to include freighters from Kenya in anticipation of increased demand for temperature-controlled transport from the region (Logistics Update Africa, 13 November).

Aircraft-to-freighter conversions using KN InteriorChain

Kuehne+Nagel has developed an integrated end-to-end logistics solution to support passenger aircraft into freighter aircraft (P2F) conversions using its KN InteriorChain service. The growth of air cargo, especially for e-commerce, suggests a need for more than 1,500 aircraft to be converted from passenger to freighter (logistics Update Africa, 2 December).

African carriers’ passenger traffic down by 78.6%

The International Air Transport Association (IATA) announced that the recovery of passenger demand continued to be disappointingly slow in October. African airlines’ traffic sank 78.6% in October, improved from an 84.9% drop in September and the best performance among the regions. Capacity contracted 67.5%, and load factor fell 23.8 percentage points to 45.5%. Total demand (measured in revenue passenger kilometres, RPK) was down 70.6% compared to October 2019. This was just a modest improvement from the 72.2% year-to-year decline recorded in September. Capacity was down 59.9% compared to a year ago, and load factor fell 21.8 percentage points to 60.2% (Logistic Update Africa, 9 December).

World Health Organization: “outrageous” air freight rates

Medical-related products have seen air cargo prices soar, despite prices as shown by the TAC Index continuing to oscillate around the “new normal” levels, with the highest rate this week from Shanghai Pudong to North America at $7.73 per kilo. But according to the WHO, carriers are charging “outrageous” prices to fly dry ice and other medical equipment. Paul Molinaro, WHO chief of operations support and logistics, told Reuters that he had been quoted $105 per kilo for a dry-ice shipment from Texas to Freetown, Sierra Leone (The Loadstar, 9 December).

Africa way ahead to accept drones

Barry Koperberg, founder and general manager of Wings For Aid, stated that Africa is way ahead when it comes to the acceptance of drones. From the humanitarian point of view, 100 million people served each year can be reached by airdrops, whereas 20 million people remain out of access. The company has recently launched a solution for mini-freight carrying 160 kg (Logistics Update Africa, 10 December).

Handler NAS to expand operations in Africa

National Aviation Services (NAS) will expand its cargo-handling operations in Africa after gaining a licence for services in the Democratic Republic of the Congo. NAS will offer ground and cargo-handling services at Kinshasa, Lubumbashi and Goma international airports. NAS’s commitment includes investments in handling equipment, infrastructure, facilities, technology and human capital (Air Cargo News, 12 November).

Burundi reopens for international flights

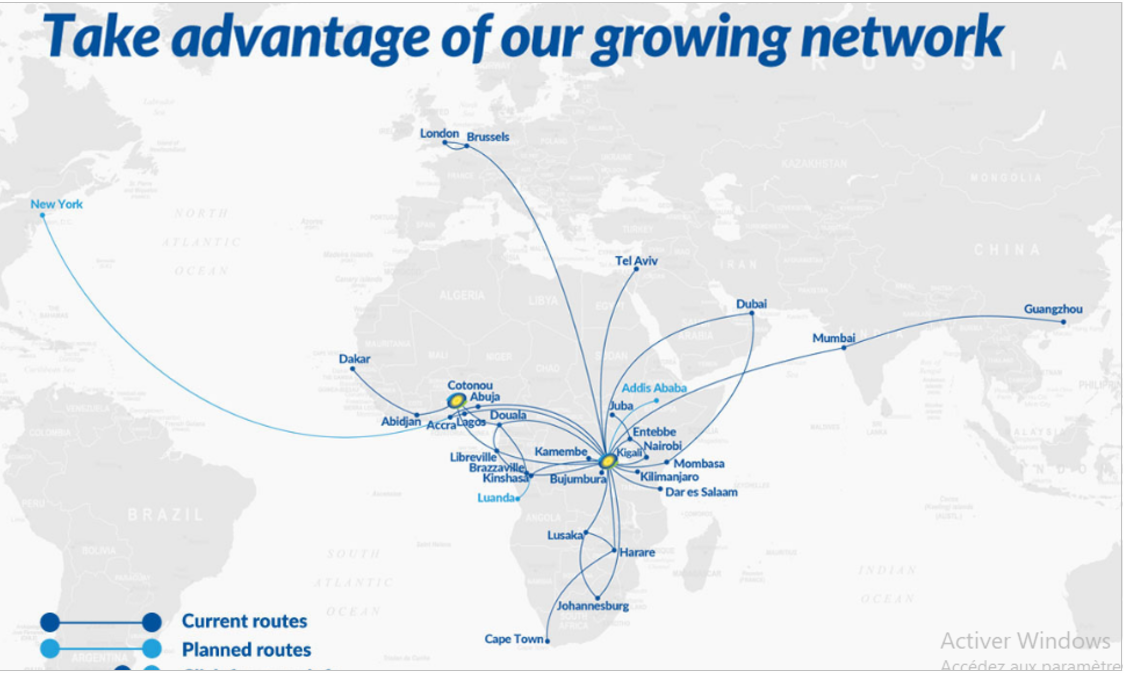

According to ch-aviation schedules, the first carrier to return was Uganda Airlines (UR, Entebbe/Kampala), which resumed 3x weekly services from Entebbe/Kampala starting on 8 November. Kenya Airways (KQ, Nairobi Jomo Kenyatta) followed close behind with 3x weekly flights from Nairobi Jomo Kenyatta on 9 November. Brussels Airlines (SN, Brussels National) is scheduled to reinstate a weekly service from Brussels National on November 17. Ethiopian Airlines (ET, Addis Ababa) resumed twice-weekly cargo flights from Addis Ababa on 10 November, and will resume daily passenger services from 18 November. RwandAir (WB, Kigali) will be coming back with 4x weekly flights from Kigali on 2 December (CH Aviation, 16 November).

Forwarding market set to rebound in 2021

The global freight forwarding market experienced its most challenging year to date amid the Covid-19 pandemic, contracting 9% year-on-year. However, it is expected to rebound in the years ahead, according to industry analyst Transport Intelligence. With promising developments for a Covid-19 vaccine, the International Monetary Fund has revised up its outlook for 2021, predicting that global trade will reach pre-Covid levels next year (Air Cargo News, 11 December).

PML invests in air-freight charter service

Perishable Movements Limited (PML), a global perishable cargo specialist, continues to provide logistics support to Kenyan exporters and UK importers, and invests in chartering its own air-freight flights to maintain its key role in securing the supply of fresh produce during the pandemic and after Brexit. PML is working with Kenya Airways, and has chartered a Boeing 787 Dreamliner aircraft that will fly from Nairobi to Heathrow twice a week and carry basic perishable goods such as fruits (avocado, mango and passion fruit), vegetables and others for PML customers looking to export out of Kenya. Many of these exported goods have an average shelf life of 21 days or less, so ensuring smooth and without delay trading between countries is key for the company. Each flight carries 36 tons of products, from January this quantity is expected to increase to 42 tons (Fructidor, 20 November).

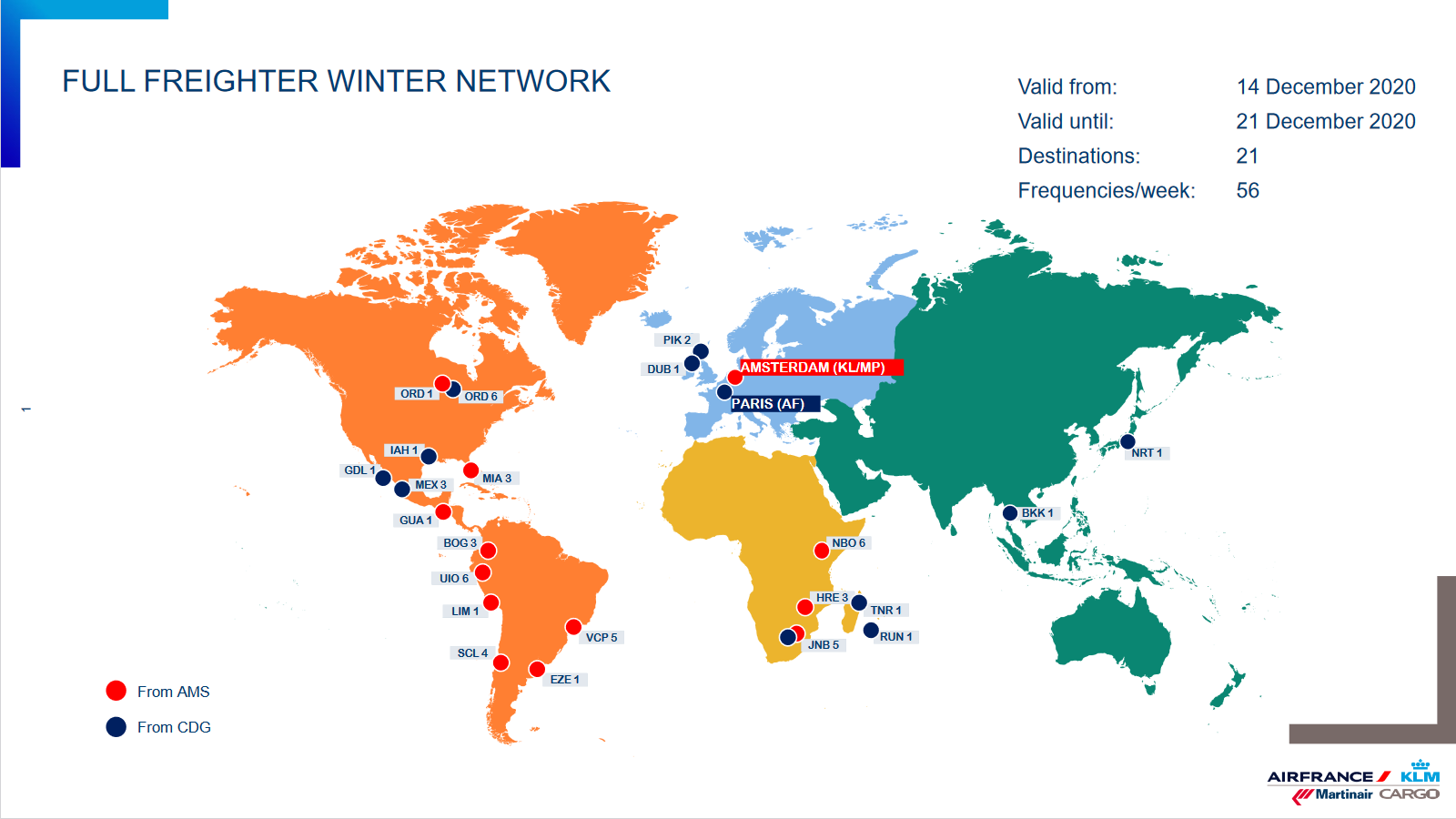

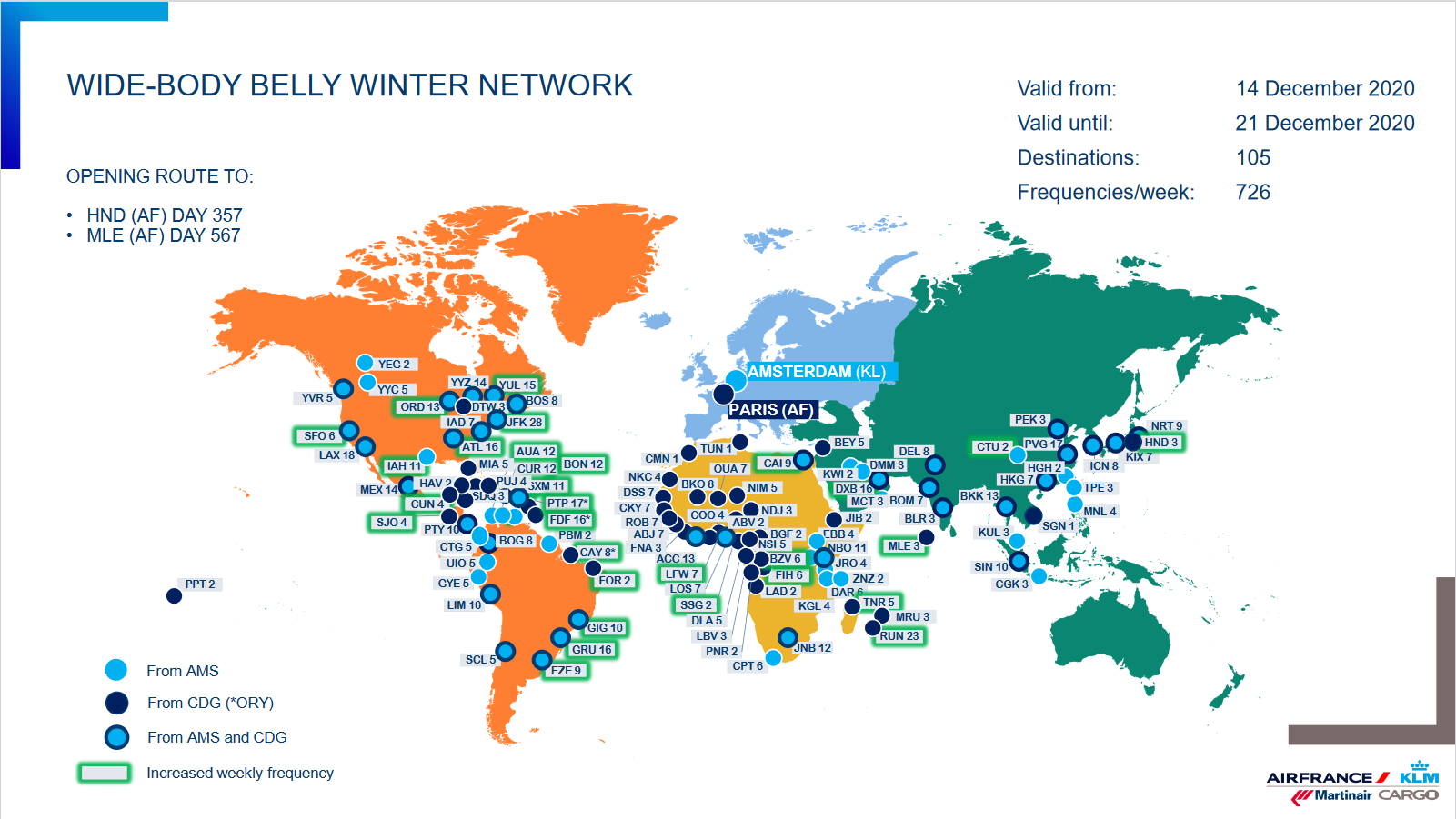

Air France KLM Martinair Cargo continues to increase the number of flights and destinations of cargo passenger belly aircraft, especially from Africa to Europe. Last week Air France-KLM increased its number of destinations worldwide from 100 to 105, and its weekly number of flights from 643 to 726, compared to last month. Increased frequencies to Africa were announced for Zanzibar and Dar-Es-Salam on Thursday and Sunday, but also to Lomé, Malabo, Brazzaville, Kinshasa, Antananarivo and Reunion.

Hub structure will be key to recovery

Network airlines with efficient hub structures will be central to the aviation industry’s recovery and lead the rebuilding of long-haul traffic, according to KLM CEO Pieter Elbers. Speaking during a keynote interview as part of the Routes Reconnected conference programme, he dismissed the suggestion that a rethink of the hub-and-spoke model might be necessary, believing that connecting traffic will return strongly once Covid-19 vaccines are available and passenger confidence returns (Routes Online, 2 December).

Fresh lockdowns prompt KLM capacity cuts

Tougher travel restrictions imposed across parts of Europe to help curb a second wave of Covid-19 have forced KLM to cut its planned seat capacity and flight frequencies. The SkyTeam member will reduce capacity within Europe to around 40% of pre-coronavirus levels over the coming months – down from the 50% it intended to operate before the latest lockdowns. Service will be suspended to a number of destinations, primarily to points in the UK. According to data provided by OAG Schedules Analyser, in the w/c 9 November KLM offered 270,000 departure seats within Europe across 81 destinations. This compares with 620,000 seats within Europe and 88 destinations during the same week a year ago (Routes Online, 13 November).

Air France-KLM ready to transport Covid-19 vaccines

Anne Rigail, CEO of Air France, announced that Air France-KLM was ready to take part in the transportation of the Covid-19 vaccines when they are ready to be commercialised. For more than 20 years, Air France has been involved in the transportation of pharmaceutical products (Forbes, 1 December).

Lufthansa – Brussels Airlines

Lufthansa Cargo and DB Schenker: first carbon-neutral freight flight

On 29 November the first CO2 neutral flight took place. This is the first step in a joint effort agreed in November to move away from fossil fuels in aviation. The aims include regular exchange of information, and promotion of environmentally friendly technologies. DB Schenker and Lufthansa Cargo are combining the start of their first CO2-neutral flights with a call to shippers, logistics providers, airfreight carriers and politicians to work together on expanding production and infrastructure, to improve the availability of sustainable aviation fuel. Both companies are leading the way and will regularly offer CO2-neutral air freight as a product for the shipping industry from the summer flight schedule onwards (Lufthansa, 27 November).

Lufthansa Cargo commits to UN sustainability goals

Lufthansa Cargo is aligning its corporate responsibility commitment to the United Nations (UN) Sustainable Development Goals. Lufthansa Cargo has committed to anchoring five selected SDGs in its corporate activities, and to making a substantial contribution to achieving these goals by 2030 (Lufthansa, 24 November).

Brussels Airlines to speed up restructuring in time for 2021

Brussels Airlines (SN, Brussels National) will accelerate its restructuring efforts under the Reboot Plus brand, which will now be 90% complete by the end of the year. This entails a 30% reduction in the fleet and a 25% smaller workforce (CH Aviation, 13 November).

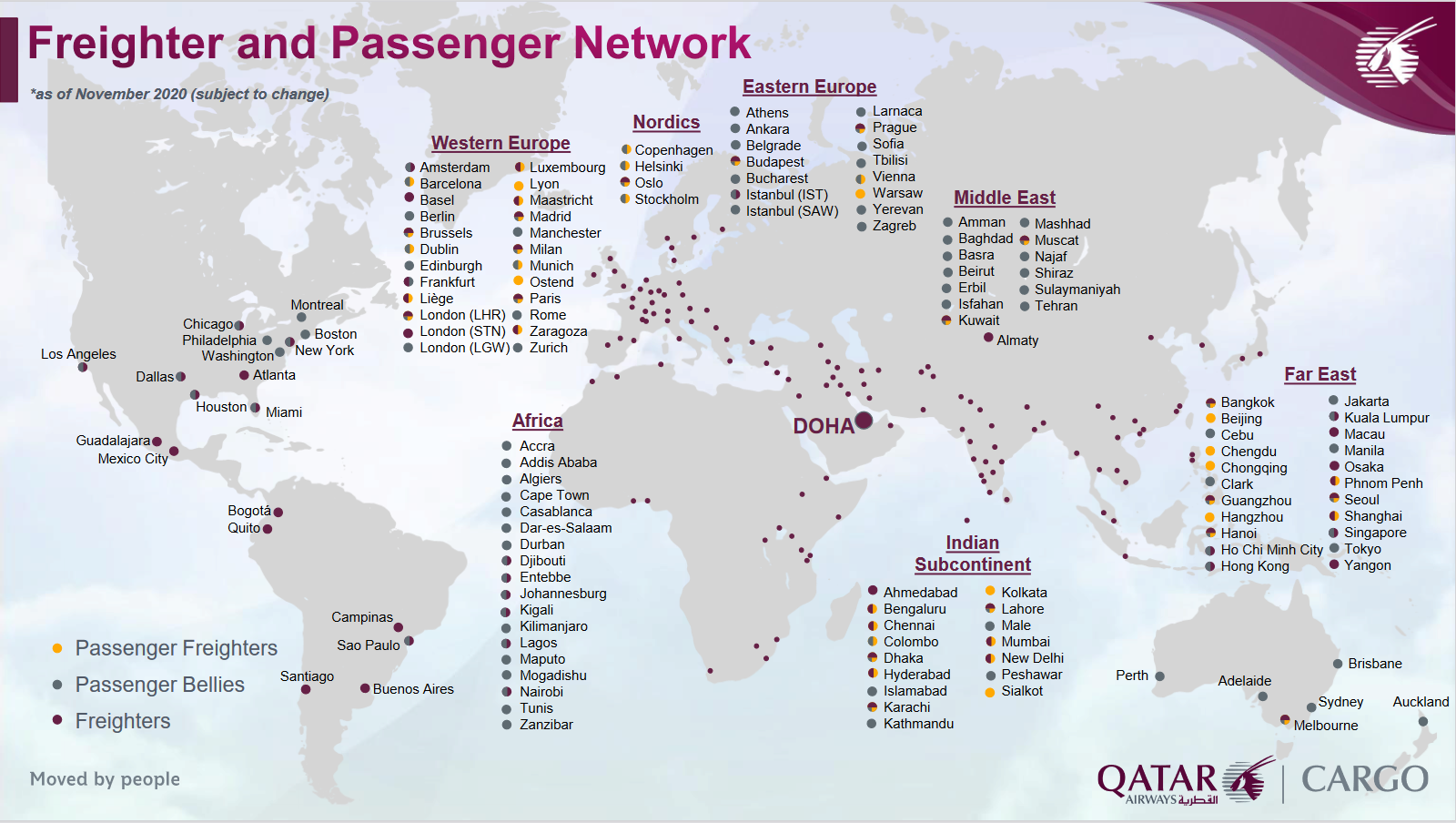

Quatar Airways‘ full freighters, which have been coming directly from Lagos to Brussels and Entebbe, and Nairobi to Liege, since the beginning of the crisis, are still programmed throughout October. However, it is reducing a considerable number of frequencies. See details below.

Route analysis: Qatar Airways adds Abuja

Qatar Airways, a oneworld alliance member, will fly 3X-weekly to Abuja’s Nnamdi Azikiwe International (ABV) from Doha’s Hamad International (DOH). Flights will operate via Nigeria’s largest city Lagos (LOS) from 27 November on board Boeing 787 Dreamliner aircraft, with 22 business class seats and 232 in economy (Routes Online, 20 November).

Virgin Atlantic has regular flights to Kenya and South Africa, and also flies to the Caribbean connecting Antigua, Grenada, Barbados and Jamaica.

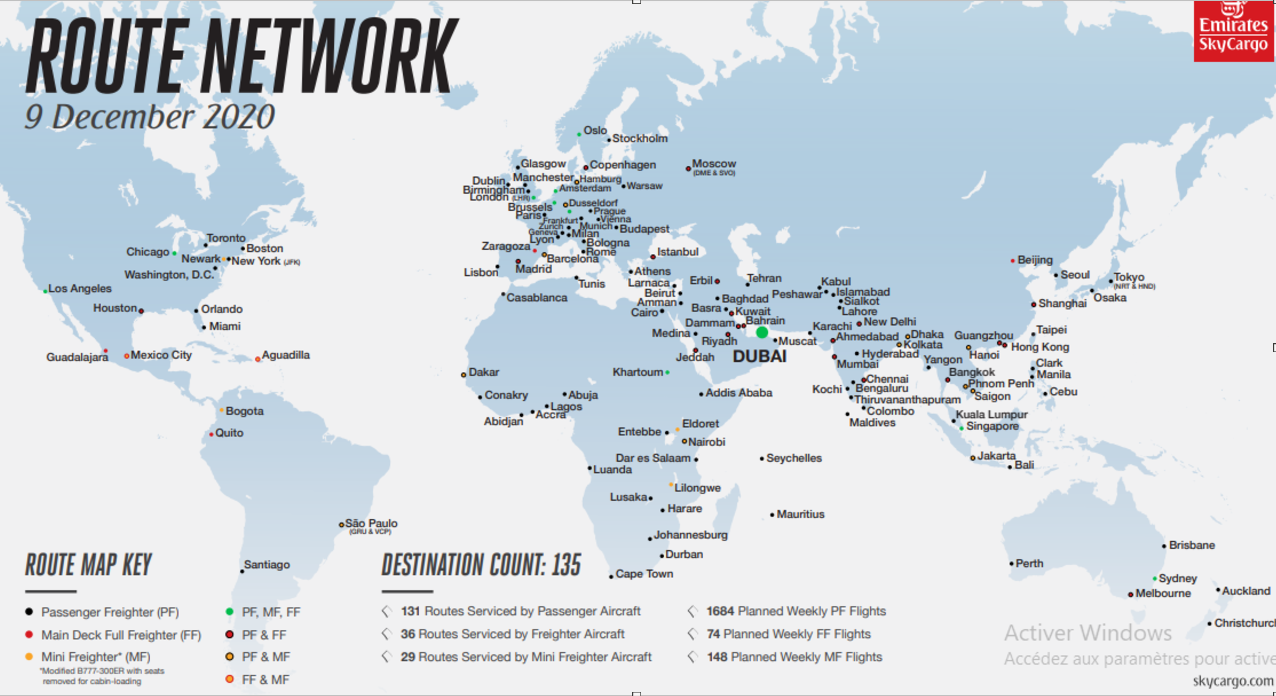

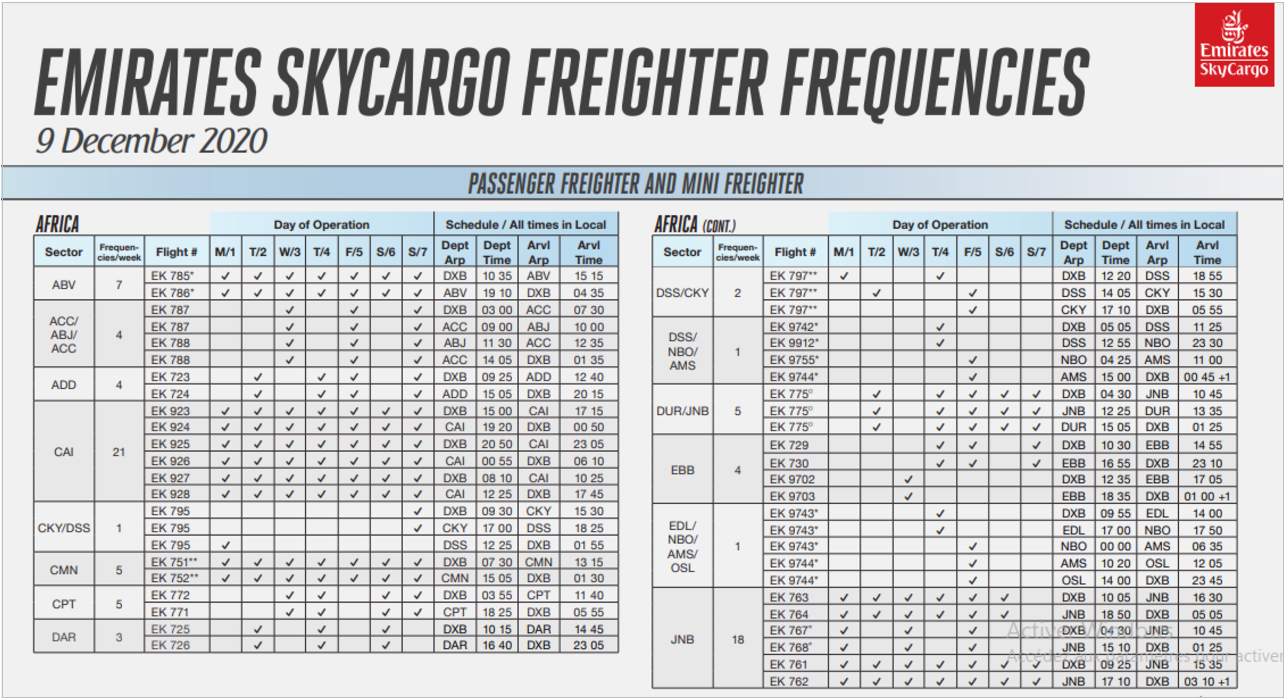

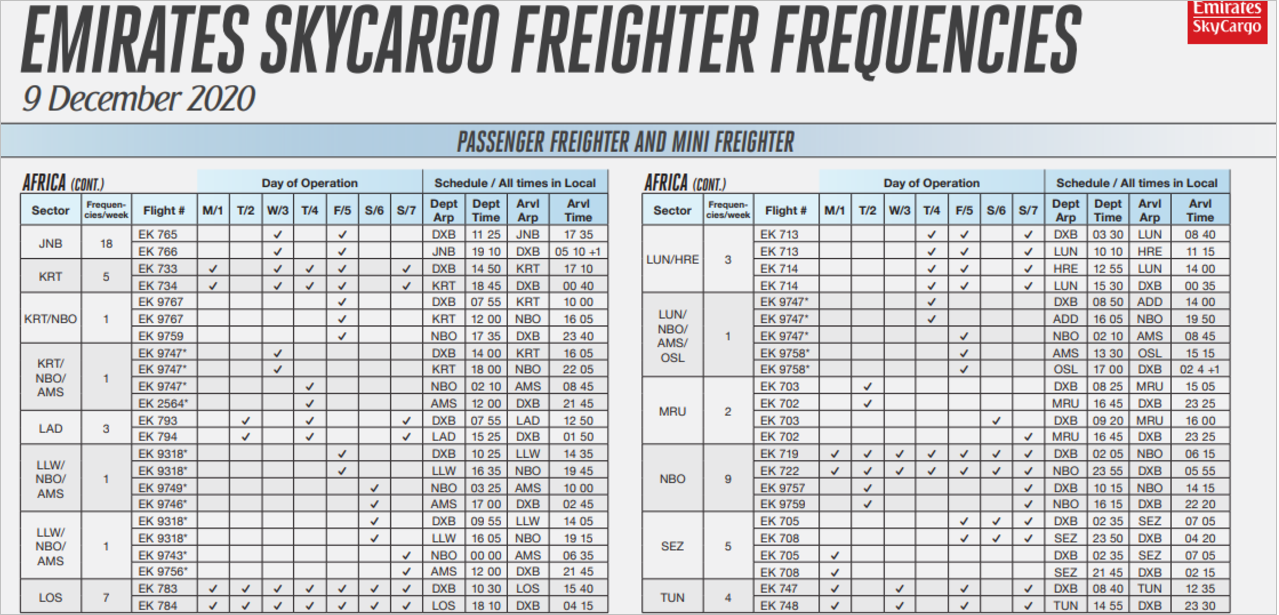

Emirates currently serves 19 countries in Africa, including: Angola, Côte d’Ivoire, Tanzania, Zimbabwe, Seychelles, Mauritius, Tunisia, Ghana, Egypt, Senegal, Guinea, Kenya, Uganda, Sudan, South Africa, Malawi, Zambia, with a connection in Dubai that relays with major airports in Europe including Brussels, Amsterdam, Frankfurt, Paris, London, Madrid, Zurich, Milan, Vienna and Maastricht. Emirates labour has been crucial in maintaining the flow of goods from African countries to 135 destinations worldwide.

Emirates SkyCargo and IHC carry relief aid

The International Humanitarian City (IHC) has chartered two additional aircraft, activating a humanitarian air bridge bringing aid to tens of thousands of refugees and displaced individuals fleeing Ethiopia to Sudan. Emirates SkyCargo-transported aid, provided by the World Health Organization and stored within IHC warehouses in Dubai, reached Ethiopia carrying 96 tonnes of medical supplies to aid an estimated 200,000 patients (logistics Update Africa, 8 December).

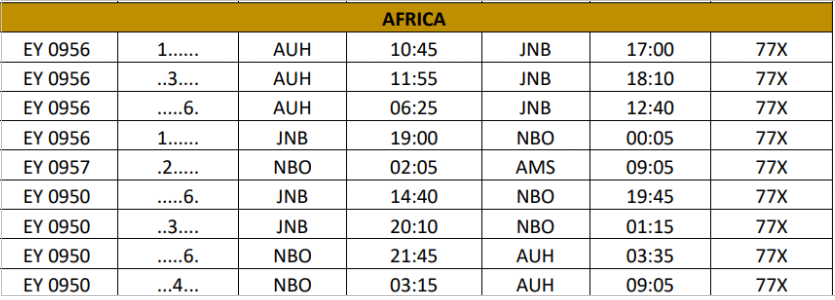

Etihad maintains its flights from South Africa and Kenya to Abu Dhabi.

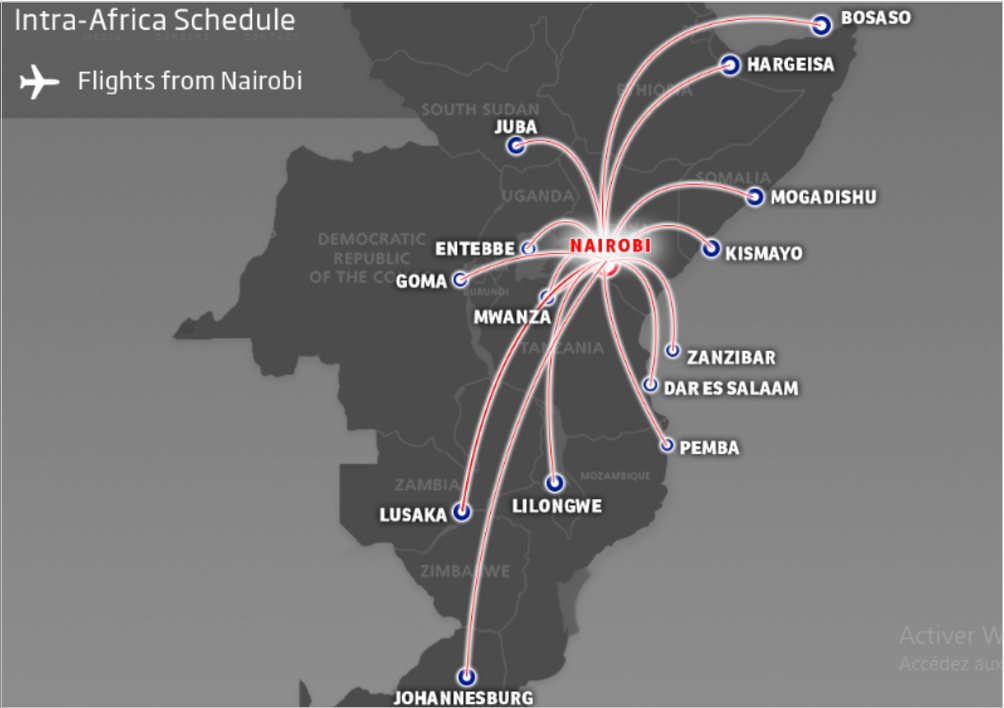

Kenya Airways is increasing its number of destinations.

Kenya Airways Cargo starts direct flight from Mombasa to Sharjah

Following the launch of direct freighter services from Johannesburg to five African destinations, Kenya Airways Cargo has launched direct cargo flights from Moi International Airport, Mombasa to Sharjah, United Arab Emirates. At first a weekly flight will be operated on Wednesdays, and as demand grows, frequencies and destinations will gradually increase. This will reduce the truck transit time of 10–12 hours from Mombasa to Nairobi (Logistics Update Africa, 26 November).

Kenya Airways Cargo – new pharma facility gets ready for vaccine logistics

Kenya Airways (KQ), through its cargo arm Kenya Airways Cargo, has invested in an ultra-modern pharma facility located at the Jomo Kenyatta International Airport (JKIA), Nairobi to meet the demand for pharmaceutical products globally and support the need to maintain product integrity throughout the supply chain. The KQ pharma facility aims to bring Africa together, to form an ecosystem of partners that goes beyond freight capabilities to ensure a sustainable, impactful approach to reducing the disease burden in Africa (logistics Update Africa, 8 December).

Kenya Airways takes up cargo slack from South African Airways

Serious problems at troubled South African Airways left a gap in the cargo market that Kenya Airways has been quick to fill. The Kenyan carrier has begun to operate direct freighter services out of Johannesburg to other southern African cities, bypassing its Nairobi hub, and adding Maputo, Harare, Lilongwe, Lusaka and Dar es Salaam (The Loadstar, 7 December).

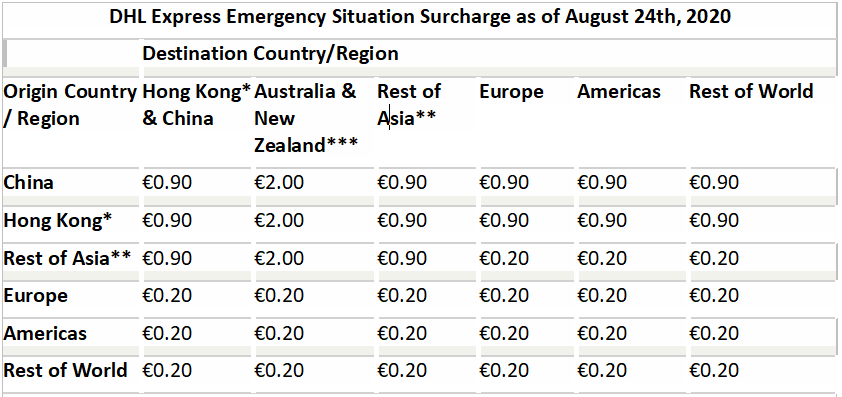

DHL: Temporary suspension of services is no longer effective for Guinea Bissau, but extended delivery times remain, and can be up to 10 additional business days for some countries of the Sub-Saharan region. There is an adjusted surcharge from 24 August:

* Hong Kong and Macau

** Rest of Asia (Asia excluding China and Hong Kong) = Bangladesh, Brunei, Bhutan, Cook Islands, Fiji, Indonesia, India, Japan, Cambodia, Kiribati, South Korea, Laos, Sri Lanka, Myanmar, Maldives, Malaysia, Mongolia, New Caledonia, Nepal, Nauru, Niue, North Korea, Tahiti, Papua New Guinea, Philippines, Pakistan, Solomon Islands, Singapore, Thailand, Timor Leste, Tonga, Tuvalu, Taiwan, Vietnam, Vanuatu, Samoa. Australia, and New Zealand as origin only.

***All shipments from Australia/New Zealand/Papua New Guinea to Australia/New Zealand/Papua New Guinea will be charged €0.20/kg regardless of billing location.

Ethiopian Cargo remains one of the key players for the African market with its current fleet of 36 cargo aircraft (12 cargo + 24 modified passenger cargo). Its hub in Addis Ababa provides a wide range of temperature-controlled warehouses, allowing connections to Europe, Asia and America. Also, there are available flights from Lagos, Lomé and Addis Ababa to Brussels and Liege. Ethiopian Cargo went from servicing 10 destinations at the beginning of the year to serve more than 70 destinations currently.

Cainiao to launch cold-chain air freight for medicines

Cainiao Smart Logistics Network, the logistics arm of Alibaba Group Holdings, has partnered with Ethiopian Airlines to launch special cold-chain air freight for the transportation of temperature-controlled medicines from Shenzhen Airport, China’s first medical cross-border cold-chain facility. Temperature-controlled medicines will be distributed twice a week from Shenzhen to Africa, and to the rest of the world via Dubai and Addis Ababa. This is China’s first cross-border medical cold-chain route to be operated regularly, and is certified to transport temperature-controlled medicines including Covid-19 vaccines (Logistics Update Africa, 9 December).

FedEx and TNT restrictions to most African countries were extended indefinitely, their service in Africa remains very limited. Detailed information is available here.

Air Seychelles has flights from Seychelles to Mauritius, Johannesburg and Tel Aviv this winter.

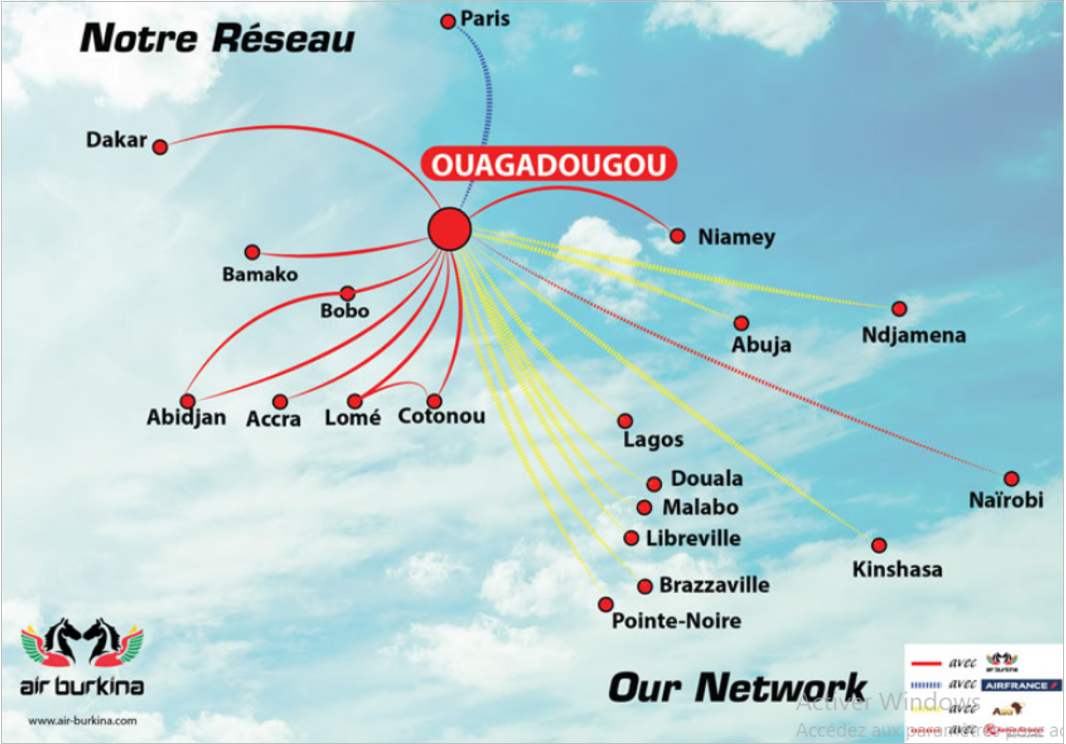

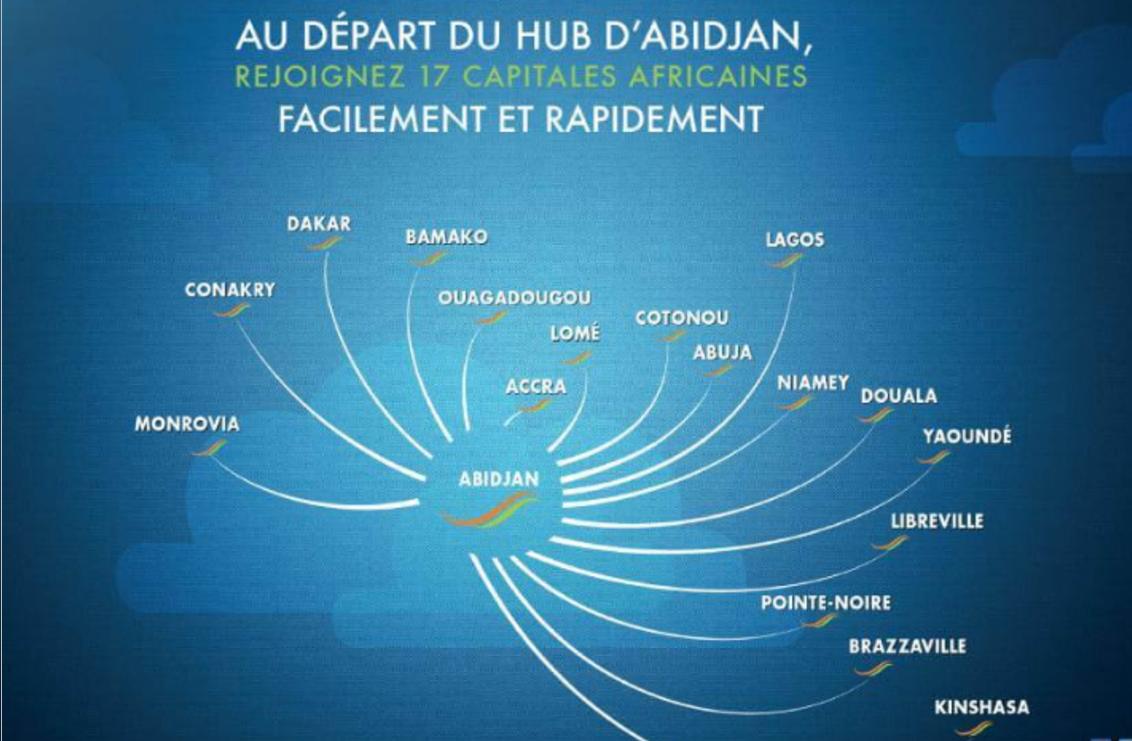

Air Burkina offers regional connections from Ouagadougou, Burkina Faso to Senegal, Mali, Côte d’Ivoire, Ghana, Togo, Benin, Niger and Ghana. Other connections available within their partners.

Royal Air Maroc has a network of direct flights covering 62 destinations worldwide in Africa, North America, Europe and the Middle East.

Airlink provides air freight transport directly to more than 35 destinations across Southern Africa.

Air Mauritius provides air freight transport directly to 22 destinations in high cargo hold capacity A350, A340 and A330.

Lam Mozambique provides airfreight to Kenya, South Africa and Tanzania.

Air Senegal offers connections to Côte d’Ivoire, Mali, Gambia, Cape Verde and Morocco, and also connects to some cities in Europe such as Barcelona, Marseille and Paris.

Uganda Airlines offers regional flights to Tanzania, Kenya and the Democratic Republic of the Congo. As part of its network expansion, Uganda Airlines will be connecting Johannesburg and Kinshasa as its next destinations. The dates are yet to be announced. From 1 December, the carrier will start flying to Zanzibar and Kilimanjaro, each three times a week (Logistics Update Africa, 30 November).

Astral Aviation specialises in air freight across several countries in Africa, and also has regular flights to Belgium and the UK. Astral is ready to support the distribution of Covid-19 vaccines to and within Africa. The Nairobi-hubbed airline, operating a fleet of 14 freighters, will use its scheduled network of 15 destinations within Africa and a further 50 destinations on charters for vaccine distribution. Astral Aviation is a member of both The International Air Cargo Association (TIACA) and Pharma.Aero, whose joint Project Sunrays initiative offers cross-industry collaboration for pharma shippers preparing for the complex logistics of vaccine distribution (Air Cargo News, 26 November).

Air Uganda operates MD87 and CRJ aircraft with three daily flights to Nairobi, daily flights to Juba, six flights a week into Dar es Salaam, two flights a week via Mombasa to Zanzibar, and six flights a week to Kigali.